Why I Use FreeAgent Accounting Software as a Work From Home Virtual Assistant

-

Why I Use FreeAgent Accounting Software as a Work From Home Virtual Assistant

- What Is FreeAgent Accounting Software?

- How I Use FreeAgent in My Virtual Assistant Business

- Reconciling Expenses in FreeAgent

- My Month-End Routine

- How I Prepare for Year-End in FreeAgent

- How I Save for Tax as a Virtual Assistant

- Do You Really Need an Accountant as a Virtual Assistant?

- Why I Like Having Both FreeAgent and an Accountant

- Conclusion

- FAQs

Why I Use FreeAgent Accounting Software as a Work From Home Virtual Assistant

When I started working from home as a Virtual Assistant back in 2011, I hired an accountant because I thought that’s what every business owner had to do. It turns out you can file your own taxes, but honestly, I’m glad I didn’t. Having an accountant makes my year-end accounts quick and stress-free and their support gives me real peace of mind. It’s one less thing I have to worry about in my business.

My accountant recommended I use FreeAgent accounting software and I’ve stuck with it ever since. I made the switch when the UK government first announced plans to Make Tax Digital.

Before that, I used spreadsheets for everything, tracking expenses in Excel and creating invoices manually. It worked, but it was slow and frustrating. Then I discovered TimeCamp, a time tracking software that automatically records my hours and generates invoices for me. It saved so much time, but I still needed a better way to manage my expenses.

That’s when moving everything into FreeAgent made perfect sense. Now my invoicing, expenses and time tracking are all in one place. The government still hasn’t fully rolled out Making Tax Digital for small businesses, but when it does, I’m ready. My accounts are digital, organised and always up to date, one less thing to worry about.

Here’s why this setup works perfectly for me as a Virtual Assistant with a small group of steady clients.

What Is FreeAgent Accounting Software?

I use FreeAgent accounting software because it’s simple, affordable and saves me time every month. I have used Xero accounting software with my clients, but for a small business like mine, there’s no need to overpay. FreeAgent keeps everything in one place, accounts, invoicing, expenses and time tracking, making it easy to stay organised and see exactly how my business is doing.

You can get FreeAgent for free through NatWest, RBS, Ulster Bank or Mettle (details here), which is handy when you’re starting out.

Having a separate business bank account makes everything much clearer. I can instantly see when I’ve been paid and what I’ve spent, without mixing personal transactions. It keeps my Virtual Assistant bookkeeping simple and stress-free, especially when I’m using FreeAgent accounting software to track everything in one place.

When I first started my work-from-home Virtual Assistant business, all my money went into one account. That was fine in the beginning, I wasn’t earning much and my focus was split between work and family life, but as my children got older and I had more time to dedicate to my clients, my income became more consistent. That’s when I decided to open a separate business bank account and it made a difference.

You don’t need to set one up straight away, but once your business finances start to grow, I’d highly recommend separating your personal and business accounts. It keeps your bookkeeping tidy and makes using FreeAgent (or any accounting software) so much easier when tax time comes around.

How I Use FreeAgent in My Virtual Assistant Business

I use FreeAgent every day. As soon as I start my computer, I open it to track my client work. The built-in time tracking software is simple, you set up each client, choose the project you’re working on and start the timer.

I also love the reporting feature, which shows exactly how much time I’ve spent on each project. This helps me share accurate updates with my clients ensuring no surprise invoices for them at month end. It’s also a great way to show the value of the work I’ve done.

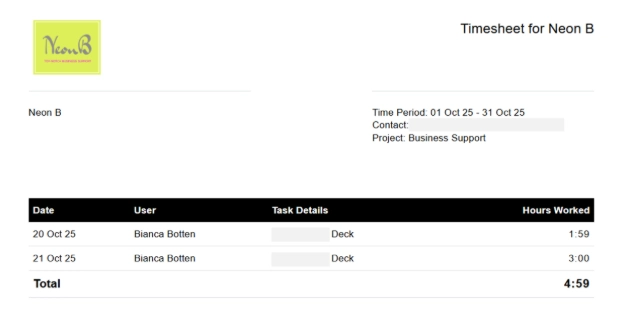

Image description: This image shows a time tracking report in FreeAgent, used to record hours worked on a client project. As a Virtual Assistant, I use this report to tell clients exactly how much time I’ve spent on each task at the end of the job.

Reconciling Expenses in FreeAgent

One of my favourite parts of using FreeAgent accounting software is how easy it is to manage expenses. I don’t have many, a few subscriptions and the odd train fare for client events, but keeping them tidy matters. FreeAgent links directly to my business bank account, all my transactions appear automatically. I simply attach the photo of the receipt and explain the transaction. It’s a huge time saver and everything stays organised in one place.

If you’re looking for affordable online accounting for self-employed work, FreeAgent does all the heavy lifting automatically, ideal if you want something simple and easy.

Watch this short video to learn how to explain a bank transaction in FreeAgent accounting software. It’s a quick step-by-step guide that helps Virtual Assistants and small business owners keep their bookkeeping accurate and up-to-date.

My Month-End Routine

At the end of each month, I block out an hour to tidy up FreeAgent and make sure everything is up-to-date. Here’s what I do:

Raise and send all invoices for the month

Reconcile receipts and attach photos in the banking tab

Chase any unpaid invoices from the previous month

Most of my clients pay within two weeks, so this quick monthly check keeps my bookkeeping smooth and stress-free. Occasionally, someone forgets to pay, but a gentle reminder always gets things back on track.

Learn how to issue invoices based on logged hours under Projects in FreeAgent accounting software. This quick tutorial below is perfect for Virtual Assistants, freelancers and small business owners who track time for client work. See how FreeAgent makes it easy to turn your time tracking into professional invoices with just a few clicks.

How I Prepare for Year-End in FreeAgent

When year-end arrives, I simply check FreeAgent is up-to-date, make sure all payments for the final month are in and then email my accountant to confirm everything’s ready. She reviews my accounts, files my tax return and lets me know how much I owe to HMRC.

Once it’s all submitted, she sends her invoice, which includes my FreeAgent subscription, and the total cost for her service is under £400 a year, well worth it for peace of mind and a smooth year-end.

How I Save for Tax as a Virtual Assistant

I work with a small group of clients each month and every time I get paid, I transfer 26% of the payment into a separate tax savings account. It takes two minutes and it means I never panic about my tax bill. It also gives me a little bonus each summer. I use what’s left for six-week holiday fun money with my kids when work slows down in August. It’s a simple way to stay organised and stress-free about tax.

This kind of planning is one of those Virtual Assistant skills that makes a big difference when your tax bill comes and when work slows down naturally over the summer.

Do You Really Need an Accountant as a Virtual Assistant?

You don’t need an accountant if you’re confident filing your own Self-Assessment, but I’m glad I have one. My accountant makes sure I claim everything I’m entitled to and keeps me compliant with HMRC. It’s one less job on my list and worth every penny.

Why I Like Having Both FreeAgent and an Accountant

FreeAgent keeps my finances organised

My accountant checks everything’s correct for tax season

I don’t worry about missing deadlines or rules

Together, they save me time, stress and mistakes

It’s a great example of combining Virtual Assistant skills and tools using software for daily tasks and expert support for accuracy. It’s also a good example of something you can automate easily in your business freeing up your time.

Conclusion

You don’t need fancy systems or a full finance team to manage your Virtual Assistant tasks and responsibilities including your finances. FreeAgent keeps things simple and my accountant keeps everything accurate.

For less than £400 a year, I get peace of mind, tidy accounts and more time to focus on my clients.

If you’re looking for accounting software then FreeAgent accounting software is a great place to start, especially if you work from home as a Virtual Assistant.

FAQs

Q1. Do Virtual Assistants need an accountant?

No, but it helps. You can file your own taxes through HMRC if you’re confident, but an accountant ensures everything’s correct and compliant.

Q2. Is FreeAgent good for Virtual Assistants?

Yes, FreeAgent accounting software is designed for freelancers and small business owners. It tracks income, expenses and tax automatically in one place, making Virtual Assistant bookkeeping quick and stress-free.

Q3. How much does FreeAgent cost?

Plans start around £14/month, but some banks like NatWest, Mettle and RBS offer it for free. Ask your accountant too, many get discounted access, which is how I pay for my FreeAgent subscription.

Q4. How do you save for taxes as a freelancer?

I move a set percentage of every invoice into a separate savings account. When the tax bill arrives, the money’s already waiting. Using online accounting software such as FreeAgent makes it easier to see what you owe and stay organised.

Now Read: Top 10 Virtual Assistant Tools (Free + Paid)

And Read: Money Mindset for Virtual Assistants

-

Why I Use FreeAgent Accounting Software as a Work From Home Virtual Assistant

- What Is FreeAgent Accounting Software?

- How I Use FreeAgent in My Virtual Assistant Business

- Reconciling Expenses in FreeAgent

- My Month-End Routine

- How I Prepare for Year-End in FreeAgent

- How I Save for Tax as a Virtual Assistant

- Do You Really Need an Accountant as a Virtual Assistant?

- Why I Like Having Both FreeAgent and an Accountant

- Conclusion

- FAQs